According to a Mastercard study in 2020,1 fifty-one percent of Americans have used some form of contactless payment. Consumers mostly use the contactless payment for buying essentials. The following is a breakdown of the percentage of transactions made with contactless payment: 2

- Grocery 85%

- Pharmacy 39%

- Retail 38%

- Quick service restaurants (QSR), fast food 36%

- Transit 9%

Is contactless payment here to stay? In 2020, according to 451 Research, credit card utilization was up 24%, and debit card usage increased 29% over the prior year. The same report also noted that 73% of Millennials and 57% of $100k+ income earners confirmed they would likely use a contactless card from their bank to make tap-to-pay purchases.3

The growth in US contactless payments is fueled by 50% of consumers stating their concern for the cleanliness of signature touchpads and 72% of consumers preferring to skip signatures altogether.

Across the globe, almost 7 in 10 consumers say the shift to digital payments will most likely be permanent. According to a study by Grandview research4, in 2020, Europe dominated the contactless payment market with 33% of the global revenue. In the near future, North America is forecasted to be the fastest-growing region for contactless payment.

Magnetic Strip and Chip-and-Pin Cards

There are two dominant forms of card-based payment methodologies in the world economy: the Magnetic Strip card used performantly in the United States and Japan and the Chip-and-Pin card used by most of the world economies. Let's take a closer look

Magnetic Strip Cards.

The magnetic strip cards5 have been in use since the 1960s. Allows the user to complete an electronic transaction or access a locked space by swiping the card with the magnet strip. The type of information in a credit card strip includes the credit card number, name, expiration date, service code and card verification code. Examples of magnetic strip cards include credit cards, employee ID cards, cards accessing hotel rooms, public transit, gift cards and more.

The magnet strip card is embedded with code/information identifying the user and is "swiped" into a retailer's payment device slot. The user is then asked to sign a copy of the paper receipt, and the signature is to be verified by the employee. These paper receipts are to be helped by the merchant, which can fade or be lost over time.

Since their introduction, magnetic strip cards have been targets of fraud by hacking the same devices used to collect credit card transactions. These devices can skim a copy of the card from the magnetic strip, which is then used to make a duplicate card used to access the users' store or online accounts.

The magnetic strip credit card is in the process of being phased out in favor of the more secure chip-and-pin card. For the end-user, that means rather than swiping the card, you can tap-to-go.

Chip-and-Pin Cards.

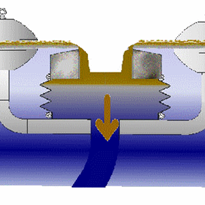

The Chip-and-pin cards6 come in the form of a credit card that requires the cardholder to authorize their transaction with a personal identification number (PIN). The card includes a square-shaped microchip that generates and stores unique information for each transaction. When a customer is making a payment transaction, the user inserts the card into the merchant's point-of-sale (POS) terminal to be read by the machine. The POS will then prompt users to enter their PIN to authorize and finalize the secure encrypted transaction. The use of the PIN bypasses the need for the user to sign a receipt. The microchip reduces the risk of counterfeiting. If a user's PIN is discovered, they can change the PIN. As of this writing, almost every major credit card issuer in the US had begun issuing contactless card technology or had announced plans to start.

Contactless Payment Transactions: NFC-enabled POS

Contactless payments allow the user to complete payment transactions without having any physical contact with the POS. Contactless payments come in two forms—mobile wallet/app payments (e.g., Apple Pay, Google Pay, Samsung pay) using smartphones and wearables (e.g., watches, payment bands, rings) or technology embedded into tap-to-go credit cards.

The Chip-and-Pin credit cardholder taps the card on the NFC-enabled POS payment terminal. At the same time, the mobile wallet user places their smartphone over the POS and then is prompted to verify the transaction by using a PIN, password, fingerprint or facial recognition.

This is made possible by the technology of "near field communication" (NFC). NFC drives contactless payments through a form of "radio frequency identification" RFID. NFC transactions are completed over an RIFD frequency that allows the card or smartphone to communicate with the payment reader within 10 centimeters or less.

Contactless payments are more secure than the Magnetic Strip and Chip-and-Pin card-based technologies because they are authenticated payments. In contactless payment, each time a transaction is initiated with an NFC-enable payment terminal, the payment terminal receives a one-time encrypted electronic token that is only used once and is associated with your credit card that is on file.

Contactless Payment Transactions: QR Codes and Smartphones

As part of the move to contactless payment, QR codes7, QR or Data Matrix code is 2D barcodes that consist of black squares arranged in a square grid on a white background, which can be read by an imaging device such as a camera. A QR barcode encodes alphanumeric information and images, website addresses, voice, and other binary data types. 2D barcodes are often issued as mobile barcodes for tickets, IDs, coupons and more. There are four advantages to the QR code. They can:

- Store large volumes of data.

- Be read even if part of the code is damaged

- Be safe because they can be encrypted

- Be scanned from a screen or paper

QR payments can be processed in any of the following ways:

- Smartphone scans the business' QR code. The QR code is scanned at the merchants' checkout, website, or paper bill to finalize payment.

- Merchant scans QR code on customer's phone. When the merchant has the total amount of the transaction in their POS, they can scan a QR code on the customer's phone and finalize it.

- App-to-app payments. You and the recipient open relevant apps. You will scan the recipient's QR code that is displayed in their app through your app. You confirm the amount to pay and tap to process the payment.

Before 2020, QR codes were used in advertising posters, event tickets, product labels and more. While the dominant contactless payment method is still a Pin-and-Chip card and mobile wallet, QR codes are becoming a viable way to accept payments at takeaway pickup points.

How Contactless Payment Drives Innovation for Merchants

According to Visa, 60% of Visa's US transactions were made at a contactless-enabled merchant location. It is estimated that three-quarters of the top 100 merchants currently offer contactless as an option at checkout. 3 That still leaves many merchants who are still deciding how they will address contactless payment. It is no simple decision. Contactless payment is not a one-fits-all solution. Merchants and organizations are faced with the need to update/refresh or roll out a new fleet to mobile-friendly EMV and contactless solutions.

This can be daunting when you consider the cost to merchants. The following are just a few of the challenges that merchants face. For example, the cost of mobile-ready terminals can start at $500. If the merchant chooses to rent, they can come with a contract and monthly membership or service package. On top of that, there is a need to work with multiple suppliers to deploy and maintain elaborate, costly, secure infrastructures. And don't forget the credit card fees that have a direct impact on the bottom line.

One company that is driving contactless payment innovation is Infinite Peripherals, with their Quantum PayTM. Infinite Peripherals has supported mobile payment for over 25 years in retail, healthcare, hospitality, travel and supply chain.

Quantum Pay is a simplified approach to deploying and maintaining a secure payment solution that includes all the components needed for secure point-to-point encryption (P2PE) hosted within a PCI-DSS certified infrastructure. As a modular system for data collection, scanning barcodes as well as contactless payment, the solution includes:

- Mobile payment devices. The Quantum Pay™ device portfolio is designed with a mobility first approach. The result is a lightweight, ergonomic, rugged, go-anywhere payment device. When wireless connectivity is lost, no problem, Quantum Pay™ will ensure no transaction is missed through online/offline payment processing support.

- Centralized management. Quantum Pay offers a centralized web-based portal that provides access to transactional data reporting at the merchant location aspect and payment device level. You won't need to access the payment terminal to initiate full or partial refunds, as this can be done from within the Quantum Pay Portal. For large or distributed estate deployments, the Quantum Pay™ Portal provides centralized remote monitoring and maintenance of payment devices, maximizing device availability and usage.

- Payment processor integration. Infinite Peripherals has partnered with leading Payment Processors to provide you with the latitude to choose the best payment processing service for your business budgets and needs. Once the preferred payment processor is selected, the Quantum Pay™ Gateway provides a frictionless, secure integration process.

How Honeywell is Helping to Make Quantum Pay Possible

At Honeywell Advanced Sensing Technologies (AST), formerly known as Sensing & Internet of Things, we have taken a lead role in designing, engineering, and manufacturing Compact 2D Barcode Scan Engines, Barcode Scan Modules, and Barcode Decoding Software. These solutions, found throughout the world, help make today's contactless and touchless experience possible in a wide variety of industry applications.

Honeywell is helping the Infinite Peripherals Quantum Pay solutions by providing the SwiftDecoderTM Software Development Kit (SDK). Honeywell SwiftDecoder SDK is a barcode decoding software that enables Infinite Peripherals to embed Honeywell's barcode scanning and decoding capabilities into their mobile payment devices, providing them the ability to decode and use information from a nearly unlimited array of barcodes and other symbologies, which offers their customers solutions that can rival the best commercial scanners. SwiftDecoder provides:

Proven performance

- 0% misreads per millions vs. competitors median misreads of 8% and freeware of 30%

- More reliable: Used by the world's largest companies to scan millions of codes every day

- Proven performance with autofocus cameras in mobile devices for close-up or long-range scanning

- Patented algorithms provide scanning at greater distances

Faster scanning speed

- Supports automatic mode set for high-speed scanning in mail, document, and package sortation

- More than 20% faster in snappiness than other enterprise software products

- More than 50% faster in reading damaged barcodes than other enterprise software products

- At least 20% faster in motion tolerance than other enterprise software products

If a customer chooses to use their smartphone, they have the option of mounting it on a pistol grip-like device that includes a Honeywell embedded scan engine. SwiftDecoder provides Infinite Peripheral customers near to far scanning capabilities (e.g., 2 inches to 25 feet) by scanning as close as few inches to 25 feet away.

Conclusion

SwiftDecoder SDK is packaged for developers, independent software vendors and other OEMs who develop barcode scanning apps or custom barcode scanner hardware. SwiftDecoder-M is for mobile platforms, while SwiftDecoder-S is for standalone, non-mobile platforms.

SwiftDecoder SDK is perfect for developers looking for a barcode decoding solution that rivals the best commercial scanners. The software is easy to integrate and offers configuration options for your applications, and easily adapts to support the latest development environments for smartphones and the latest updates for operating systems. Additionally, many developers can benefit from software integration support. For more information, visit sps.honeywell.com

-160x160-state_article-rel-cat.jpg)

-160x160-state_article-rel-cat.png)