Waste recycling volumes have also risen over the period, supported by greater community awareness, rising waste recovery targets and increasing landfill levies, which have encouraged the diversion of waste away from disposal sites. However, in January 2018 the Chinese Government implemented a ban on imports of 24 types of recyclable waste. The ban is aiming to reduce pollution in the country and protect the health of Chinese citizens and their environment. This policy has upended Australia’s waste management sector, which is anticipated to face difficult and uncertain operating conditions over the next five years.

Firms in the Waste Remediation and Materials Recovery Services industry remediate contaminated buildings and mine sites; sort, recycle and recover waste material; and onsell recovered materials, such as steel. In comparison, firms in the Waste Treatment and Disposal Services industry treat or dispose of waste, principally through the operation of landfill sites and waste transfer stations. Waste treatment and disposal firms are charged levies by state and territory governments on waste sent to landfill facilities, which are passed on to businesses and consumers.

Both industries have benefited from Australia’s steady population growth over the past five years, which has contributed to rising volumes of household waste such as paper, e-waste, plastic and fabric. Strong construction activity on the east coast has also boosted volumes of masonry, metal and glass waste over the five-year period. Large portions of municipal, industrial and construction waste are recyclable or recoverable. Federal, state and local government policies have supported the Waste Remediation and Materials Recovery Services industry’s expansion over the past five years. In particular, landfill levies have increased, reducing demand for the Waste Treatment and Disposal Services industry and encouraging recycling or remediation of reuseable waste. Historically, a significant amount of recyclable waste that was produced in Australia was onsold overseas, contributing a key source of revenue for waste remediation and recovery firms. Prior to the ban, an estimated 600,000 tonnes of recyclable waste material was sold to China each year, which amounted to approximately 30% Australia’s recyclable waste.

China’s ban on imports of recyclable waste has drastically impacted firms across the entire waste management sector. Since January 2018, China has not accepted 24 categories of recyclable material that is more than 0.5% contaminated. These categories include plastics, paper, cotton and wool waste, and scalings from iron and steel manufacturing. Contamination levels below 0.5% are extremely difficult to achieve, particularly for household waste. As a result, most of the material that otherwise would have been exported to China will likely require recycling or recovery onshore. The volume of waste handled by firms in the Waste Remediation and Materials Recovery Services industry is anticipated to soar over the next five years. Furthermore, higher amounts of recoverable materials such as iron, glass, plastic and steel are expected to contribute to falling prices for these commodities, which will likely place downward pressure on the industry’s revenue.

Where waste remediation and recovery facilities reach full capacity, excess recoverable waste will likely be diverted to the Waste Treatment and Disposal Services industry. As a result, the volume of waste handled by disposal and landfill sites is also projected to increase, boosting revenue for the industry’s firms over the next five years. However, landfill levies will likely rise over the next five years as the costs of handling higher volumes of waste increase, constraining industry growth.

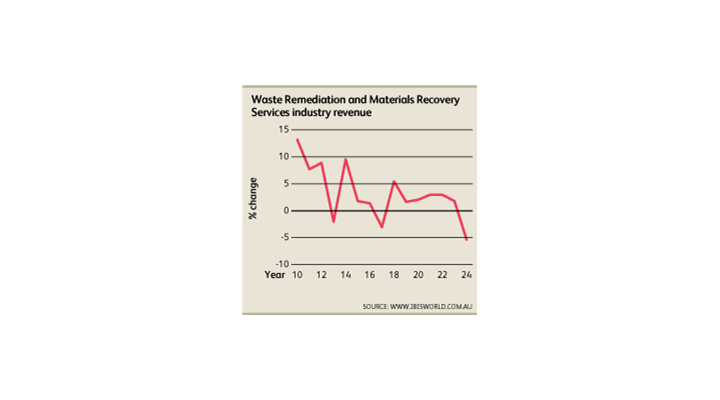

Despite the significant uncertainty and strain caused by the Chinese ban, the waste management sector is still projected to grow over the next five years. Recyclable and non-recyclable waste generation is forecast to rise over the period, due to the growing population and increasing construction and manufacturing activity. Combined with the recent ban, waste management firms are anticipated to handle accelerating volumes of waste, supporting their expansion and revenue growth. The Waste Remediation and Materials Recovery Services industry’s revenue is projected to increase at an annualised 2.3% over the five years through 2022-23, to $5.6 billion. The Waste Treatment and Disposal Services industry is forecast to grow at an annualised 2.4% over the five-year period, to $2.9 billion.

Want to comment on this topic? Click 'Have Your Say' and add your thoughts.